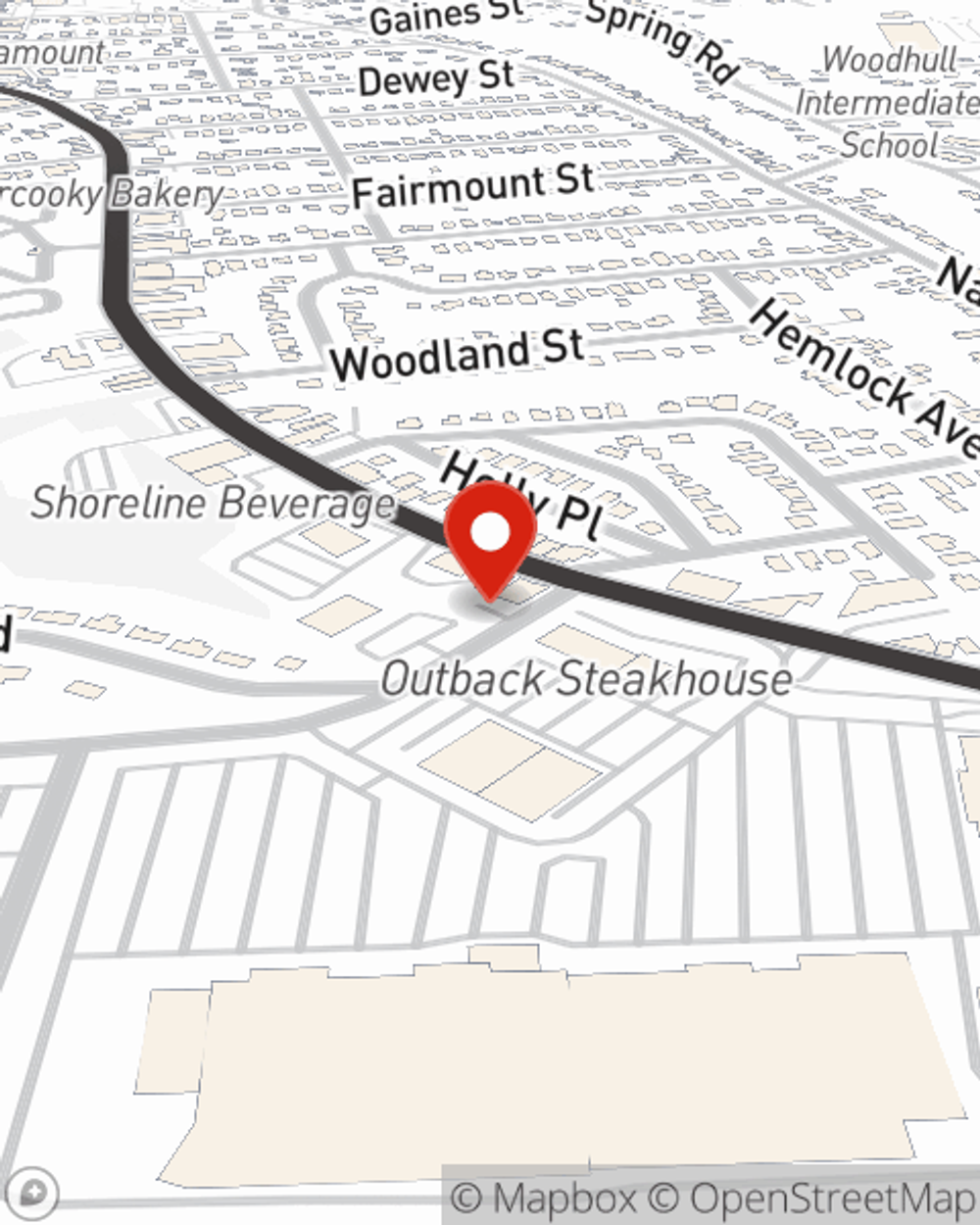

Business Insurance in and around Huntington

Looking for small business insurance coverage?

Insure your business, intentionally

Coverage With State Farm Can Help Your Small Business.

Preparation is key for when something unavoidable happens on your business's property like a staff member getting hurt.

Looking for small business insurance coverage?

Insure your business, intentionally

Get Down To Business With State Farm

The unexpected is, well, unexpected, but you shouldn't wait until something happens to make sure you're properly prepared. State Farm has a wide range of coverages, like extra liability or worker's compensation for your employees, that can be molded to develop a personalized policy to fit your small business's needs. And when the unexpected does arise, agent Chris Stewart can also help you file your claim.

So, take the responsible next step for your business and call or email State Farm agent Chris Stewart to identify your small business insurance options!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Chris Stewart

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.